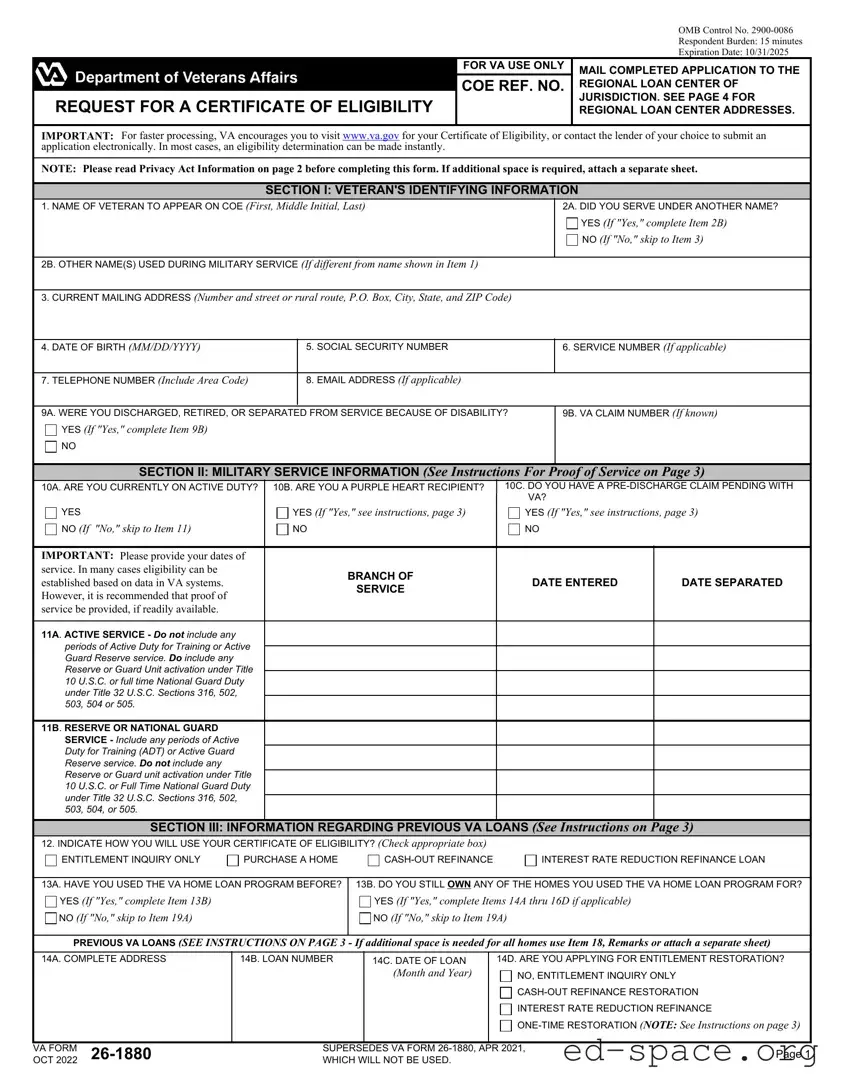

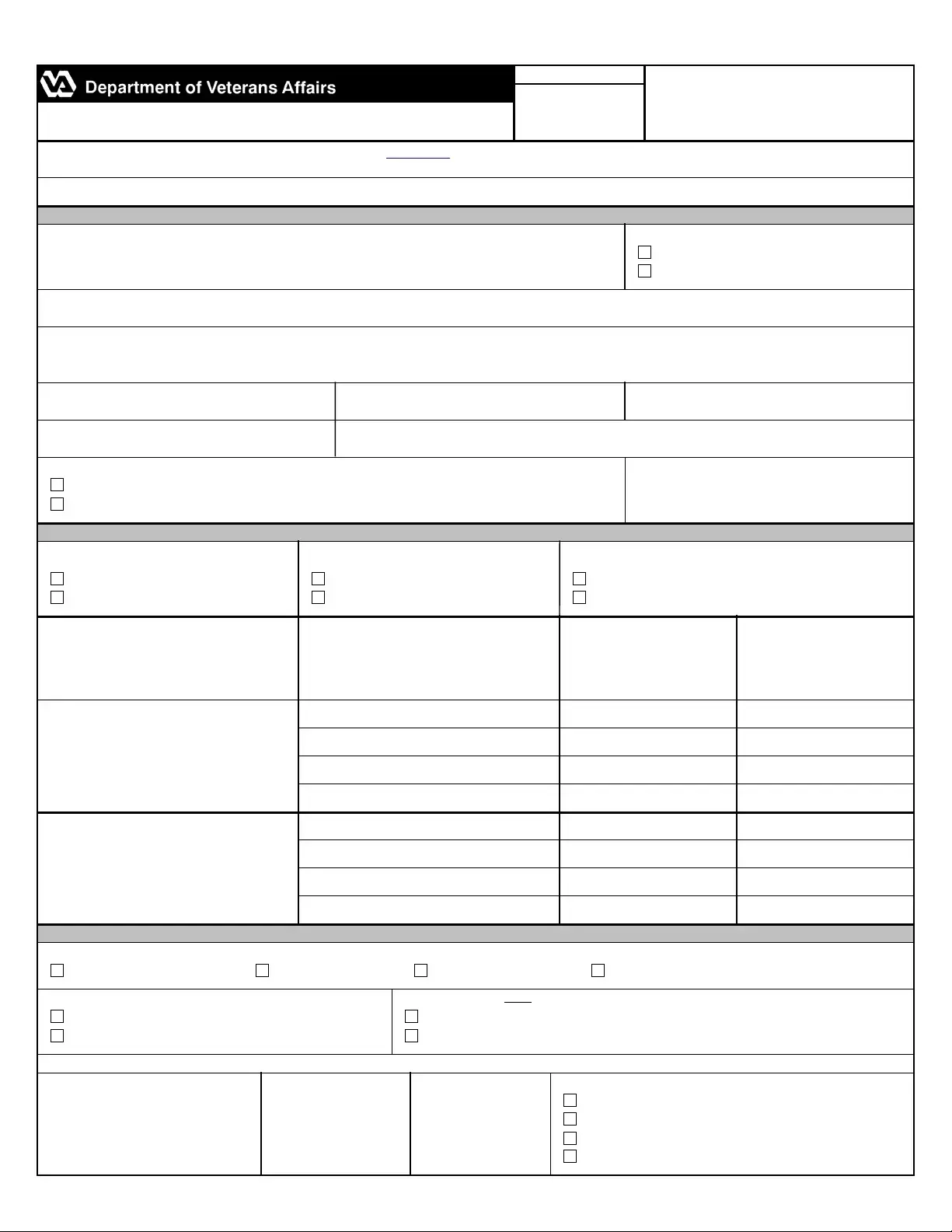

ITEM 12 - Indicate how you will use your certificate of eligibility.

ITEM 13A - Indicate if you have ever had a VA-guaranteed home loan.

ITEM 13B - Indicate if you still own any homes you financed with a VA-guaranteed loan.

ITEMS 14D, 15D, 16D - Select the applicable type of restoration being requested. Indicate if you are applying for a restoration of entitlement.

INSTRUCTIONS FOR VA FORM 26-1880

SECTION III - INFORMATION REGARDING PREVIOUS LOANS

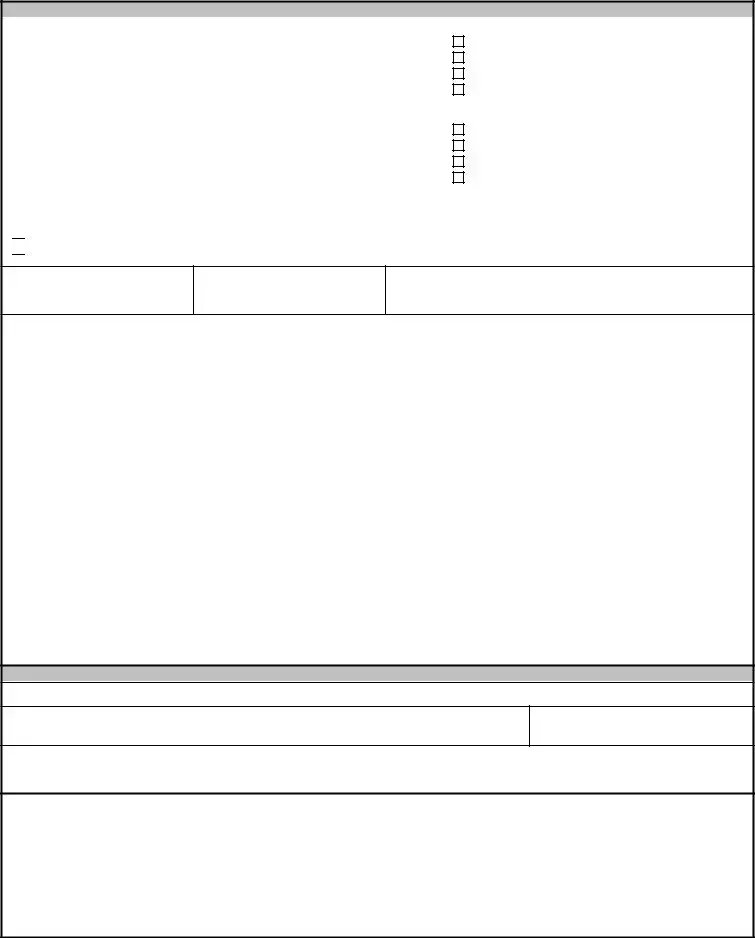

Your eligibility is reusable depending on the circumstances. Generally, if you have paid off your prior VA loan and no longer own the home, you can have your used eligibility

restored for additional use. Also, on a one-time only basis, you may have your eligibility restored if your prior VA loan has been paid in full but you still own the home.

Generally, VA receives notification that a loan has been paid. In some instances, it may be necessary to include evidence that a previous VA loan has been paid in full.

Evidence can be in the form of a paid-in-full statement from the former lender, a satisfaction of mortgage from the clerk of court in the county where the home is located, or a

copy of the HUD-1 or Closing Disclosure settlement statement completed in connection with a sale of the home or refinance of the prior loan. Many counties post public

documents (like the satisfaction of mortgage) online.

SECTION I. VETERAN'S IDENTIFYING INFORMATION

Item 1 - Tell us your complete name, as you would like it to appear on your Certificate of Eligibility (COE). If this name is different than what is shown on your service

documents or in VA records provide documentation such as a marriage certificate, divorce decree, or court document to support the request. Do NOT send originals, copies of

these documents are acceptable.

Item 2A - Indicate if you served under another name, provide the name as it appears on your discharge certificate (DD Form 214).

Item 2B - Provide the name as it appears on your discharge certificate (DD Form 214)

Item 9B - In most cases your claim number is the same as your Social Security number. If you are not sure about this number, leave this field blank.

SECTION II. MILITARY SERVICE INFORMATION

Item 10A - Indicate if you are currently serving on active duty.

Item 10B - The VA funding fee may not be collected from a member of the Armed Forces who is currently serving on active duty and has been awarded the Purple Heart. You

may be asked to provide evidence of having been awarded the Purple Heart. Note: Activations under Title 32 orders are not considered active duty for the purpose of a funding

fee exemption.

Item 10C - The VA funding fee may not be collected from a veteran who rated eligible to receive compensation as the result of a pre-discharge disability examination and

rating or based on a pre-discharge review of existing medical evidence (including service medical and treatment records) that results in the issuance of a memorandum rating.

Note: If the proposed or memorandum rating is not obtained and a closing takes place, the funding fee exemption does not apply, and the

service-member will not be entitled to a refund.

Items 11A and 11B - List your periods of military service.

Item 11A - Active Service: full-time duty in the Armed forces, other than active duty for training. The best evidence to show your service is your discharge certificate

(DD Form 214), which indicates both character of service and the narrative reason for separation. A copy is acceptable. Note: Cases involving other than honorable discharges

will usually.require further development by VA. This is necessary to determine if the service was under other than dishonorable conditions.

If you are currently serving on regular active duty, eligibility can usually be established based on data in VA systems. However, in some situations you may be asked to

provide a statement of service signed by, or by direction of, the adjutant, personnel officer, or commander of your unit or higher headquarters. The statement may be in any

format; usually a standard or bulleted memo is sufficient. It should identify you by name and social security number and provide: (1) your date of entry on your current active-

duty period and (2) the duration of any time lost (or a statement noting there has been no time lost). Generally, this should be on military letterhead.

National Guard members who served full time duty (only includes activations considered Full Time National Guard duty that is not inactive duty) under Title 32, U.S.C.

sections 316, 502, 503, 504 or 505, may provide a DD Form 220, DD Form 214 or Report of Active Service, accompanied by orders for the same period is also acceptable.

Copies are acceptable. If you are still serving on the activation, you should provide a statement of service that indicates (1) your date of entry on your current active-duty period

and (2) the duration of any time lost (or a statement noting there has been no time lost), type of orders, if orders are for training, entry date for your current activation.

Generally, this should be on military letterhead.

Item 11B - National Guard Service/Selected Reserve Service: You may submit for Selected Reserve Service Retirement Points Accounting and evidence of discharge

which indicates the character of service, or their equivalent. For National Guard Service you may submit NGB Form 22, Report of Separation and Record of Service or NGB

Form 23, Retirement Points Accounting, or their equivalent. If you are still serving in the Selected Reserves or the National Guard, you must include an original statement of

service signed by, or by the direction of, the adjutant, personnel officer, or commander of your unit or higher headquarters showing your date of entry and the number of

creditable years (years in which you earned more that 15 points). At least 6 years of honorable service must be documented.

VA FORM 26-1880, OCT 2022

Page 3

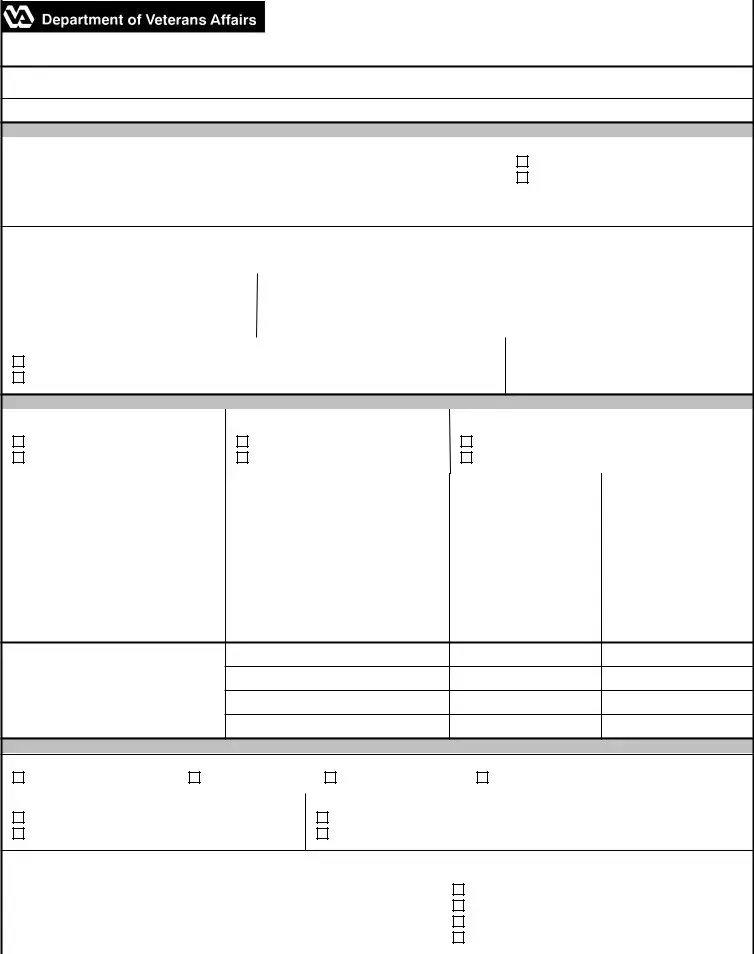

ITEM 17A - Disaster related. Indicate if you still own a home that was destroyed or substantially damaged by a Federally Declared Natural Disaster.

• Regular (cash-out) Refinance - You may refinance your current VA or non-VA loan in order to pay off the mortgage and/or other liens of record on the home. This

type of refinance requires an appraisal and credit qualifying.

• Interest Rate Reduction Refinancing Loan (IRRRL) - You may refinance the balance of your current VA loan in order to obtain a lower interest rate or convert a

VA adjustable rate mortgage to a fixed rate. The new loan may not exceed the sum of the outstanding balance on the existing VA loan, plus allowable fees and

closing costs, including VA funding fee and up to 2 discount points. You may also add up to $6,000 of energy efficiency improvements into the loan.

• One-Time Restoration. If you have paid off your VA loan, but still own the home purchased with that loan, you may apply for a one-time only restoration of your

entitlement in order to purchase another home that will be your primary residence. Once you have used your one-time restoration, you must sell all homes before

any other entitlement can be restored.