|

2. |

First Name, Middle Initial and Last Name (if joint, use first names and initials of both) |

|

|

3. Your Social Security Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

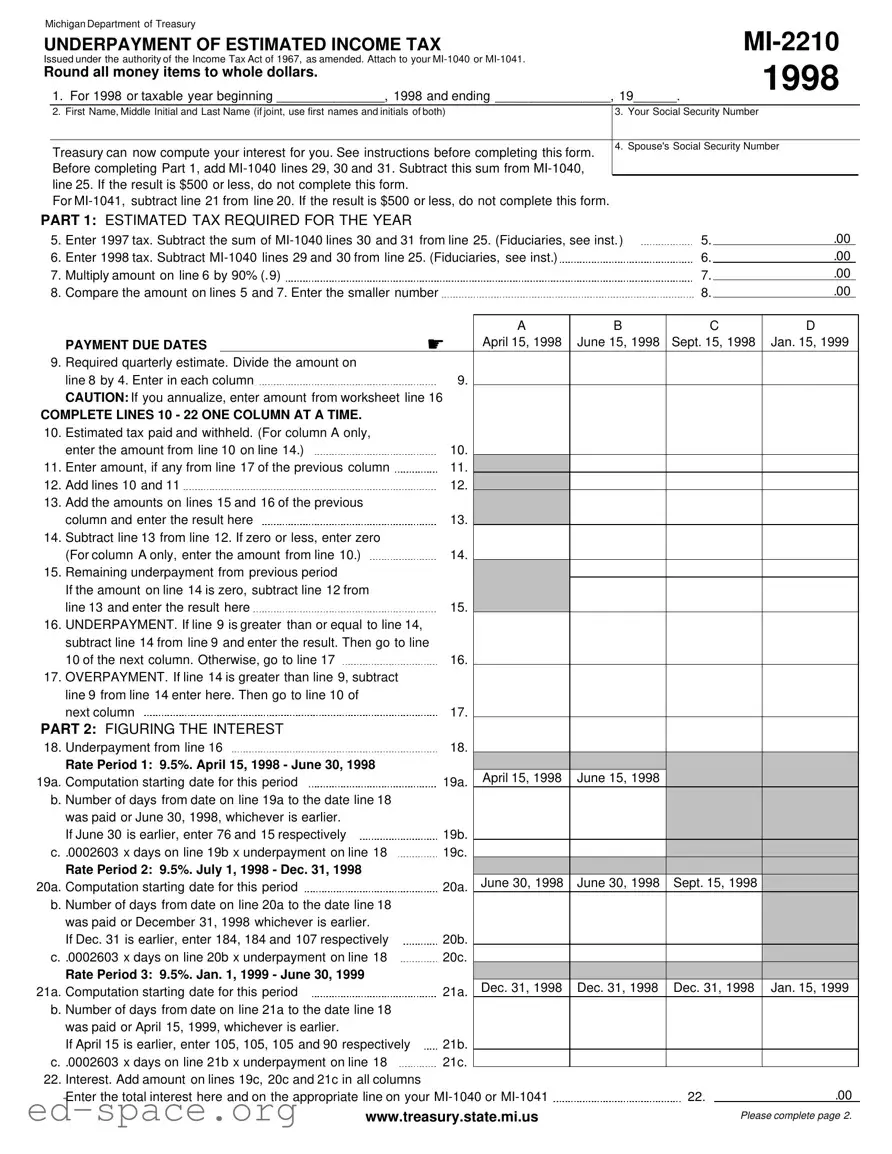

Treasury can now compute your interest for you. See instructions before completing this form. |

4. Spouse's Social Security Number |

|

|

|

|

|

|

Before completing Part 1, add MI-1040 lines 29, 30 and 31. Subtract this sum from MI-1040, |

|

|

|

|

|

line 25. If the result is $500 or less, do not complete this form. |

|

|

|

|

|

|

|

|

|

For MI-1041, subtract line 21 from line 20. If the result is $500 or less, do not complete this form. |

|

|

|

|

PART 1: ESTIMATED TAX REQUIRED FOR THE YEAR |

|

|

|

|

|

|

|

|

5. |

Enter 1997 tax. Subtract the sum of MI-1040 lines 30 and 31 from line 25. (Fiduciaries, see inst. ) |

5. |

|

.00 |

6. |

Enter 1998 tax. Subtract MI-1040 lines 29 and 30 from line 25. (Fiduciaries, see inst.) |

|

|

6. |

|

.00 |

7. |

Multiply amount on line 6 by 90% (.9) |

|

|

|

|

|

7. |

|

.00 |

8. |

Compare the amount on lines 5 and 7. Enter the smaller number |

|

|

|

|

8. |

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

|

B |

C |

D |

|

|

PAYMENT DUE DATES |

|

☛ |

April 15, 1998 |

June 15, 1998 |

Sept. 15, 1998 |

Jan. 15, 1999 |

9. |

Required quarterly estimate. Divide the amount on |

|

|

|

|

|

|

|

|

|

|

line 8 by 4. Enter in each column |

|

9. |

|

|

|

|

|

|

|

|

CAUTION: If you annualize, enter amount from worksheet line 16 |

|

|

|

|

|

|

|

COMPLETE LINES 10 - 22 ONE COLUMN AT A TIME. |

|

|

|

|

|

|

|

|

10. |

Estimated tax paid and withheld. (For column A only, |

|

|

|

|

|

|

|

|

|

|

enter the amount from line 10 on line 14.) |

|

10. |

|

|

|

|

|

|

11. |

Enter amount, if any from line 17 of the previous column |

|

11. |

|

|

|

|

|

|

12. |

Add lines 10 and 11 |

|

12. |

|

|

|

|

|

|

13. |

Add the amounts on lines 15 and 16 of the previous |

|

|

|

|

|

|

|

|

|

|

column and enter the result here |

|

13. |

|

|

|

|

|

|

14. |

Subtract line 13 from line 12. If zero or less, enter zero |

|

|

|

|

|

|

|

|

|

|

(For column A only, enter the amount from line 10.) |

|

14. |

|

|

|

|

|

|

15. |

Remaining underpayment from previous period |

|

|

|

|

|

|

|

|

|

|

If the amount on line 14 is zero, subtract line 12 from |

|

|

|

|

|

|

|

|

|

|

line 13 and enter the result here |

|

15. |

|

|

|

|

|

|

16. |

UNDERPAYMENT. If line 9 is greater than or equal to line 14, |

|

|

|

|

|

|

|

|

|

|

subtract line 14 from line 9 and enter the result. Then go to line |

|

|

|

|

|

|

|

17. |

10 of the next column. Otherwise, go to line 17 |

|

16. |

|

|

|

|

|

|

OVERPAYMENT. If line 14 is greater than line 9, subtract |

|

|

|

|

|

|

|

|

|

|

line 9 from line 14 enter here. Then go to line 10 of |

|

|

|

|

|

|

|

|

|

|

next column |

|

17. |

|

|

|

|

|

|

PART 2: FIGURING THE INTEREST |

|

|

|

|

|

|

|

|

18. |

Underpayment from line 16 |

|

18. |

|

|

|

|

|

|

|

|

Rate Period 1: 9.5%. April 15, 1998 - June 30, 1998 |

|

|

|

|

|

|

|

|

19a. |

Computation starting date for this period |

|

19a. |

April 15, 1998 |

June 15, 1998 |

|

|

|

|

b. Number of days from date on line 19a to the date line 18 |

|

|

|

|

|

|

|

|

|

|

was paid or June 30, 1998, whichever is earlier. |

|

|

|

|

|

|

|

|

|

|

If June 30 is earlier, enter 76 and 15 respectively |

|

19b. |

|

|

|

|

|

|

|

c. .0002603 x days on line 19b x underpayment on line 18 |

|

19c. |

|

|

|

|

|

|

|

|

Rate Period 2: 9.5%. July 1, 1998 - Dec. 31, 1998 |

|

|

|

|

|

|

|

|

20a. |

Computation starting date for this period |

|

20a. |

June 30, 1998 |

June 30, 1998 |

Sept. 15, 1998 |

|

|

b. Number of days from date on line 20a to the date line 18 |

|

|

|

|

|

|

|

|

|

|

was paid or December 31, 1998 whichever is earlier. |

|

|

|

|

|

|

|

|

|

|

If Dec. 31 is earlier, enter 184, 184 and 107 respectively |

|

20b. |

|

|

|

|

|

|

|

c. .0002603 x days on line 20b x underpayment on line 18 |

|

20c. |

|

|

|

|

|

|

|

|

Rate Period 3: 9.5%. Jan. 1, 1999 - June 30, 1999 |

|

|

|

|

|

|

|

|

21a. |

Computation starting date for this period |

|

21a. |

Dec. 31, 1998 |

Dec. 31, 1998 |

Dec. 31, 1998 |

Jan. 15, 1999 |

|

b. Number of days from date on line 21a to the date line 18 |

|

|

|

|

|

|

|

|

|

|

was paid or April 15, 1999, whichever is earlier. |

|

|

|

|

|

|

|

|

|

|

If April 15 is earlier, enter 105, 105, 105 and 90 respectively |

|

21b. |

|

|

|

|

|

|

|

c. .0002603 x days on line 21b x underpayment on line 18 |

|

21c. |

|

|

|

|

|

|

22. |

Interest. Add amount on lines 19c, 20c and 21c in all columns |

|

|

|

|

|

|

|

|

|

|

Enter the total interest here and on the appropriate line on your MI-1040 or MI-1041 |

|

|

22. |

|

.00 |