entity's requested classification for all of the years the entity intended the requested election to be effective and no inconsistent tax or information returns have been filed during any of the tax years.

3.The entity has reasonable cause for its failure to timely make the entity classification election.

4.Three years and 75 days from the requested effective date of the eligible entity's classification election have not passed.

Affected person. An affected person is either:

•with respect to the effective date of the eligible entity's classification election, a person who would have been required to attach a copy of the Form 8832 for the eligible entity to its federal tax or information return for the tax year of the person which includes that date; or

•with respect to any subsequent date after the entity's requested effective date of the classification election, a person who would have been required to attach a copy of the Form 8832 for the eligible entity to its federal tax or information return for the person's tax year that includes that subsequent date had the election first become effective on that subsequent date.

For details on the requirement to attach a copy of Form 8832, see Rev. Proc. 2009-41 and the instructions under Where To File.

To obtain relief, file Form 8832 with the applicable IRS service center listed in Where To File, earlier, within 3 years and 75 days from the requested effective date of the eligible entity's classification election.

If Rev. Proc. 2009-41 does not apply, an

entity may seek relief for a late entity election by requesting a private letter ruling and paying a user fee in accordance with Rev. Proc. 2013-1, 2013-1 I.R.B. 1 (or its successor).

Line 11. Explain the reason for the failure to file a timely entity classification election.

Signatures. Part II of Form 8832 must be signed by an authorized representative of the eligible entity and each affected person. See Affected Persons, earlier. The individual or individuals who sign the declaration must have personal knowledge of the facts and circumstances related to the election.

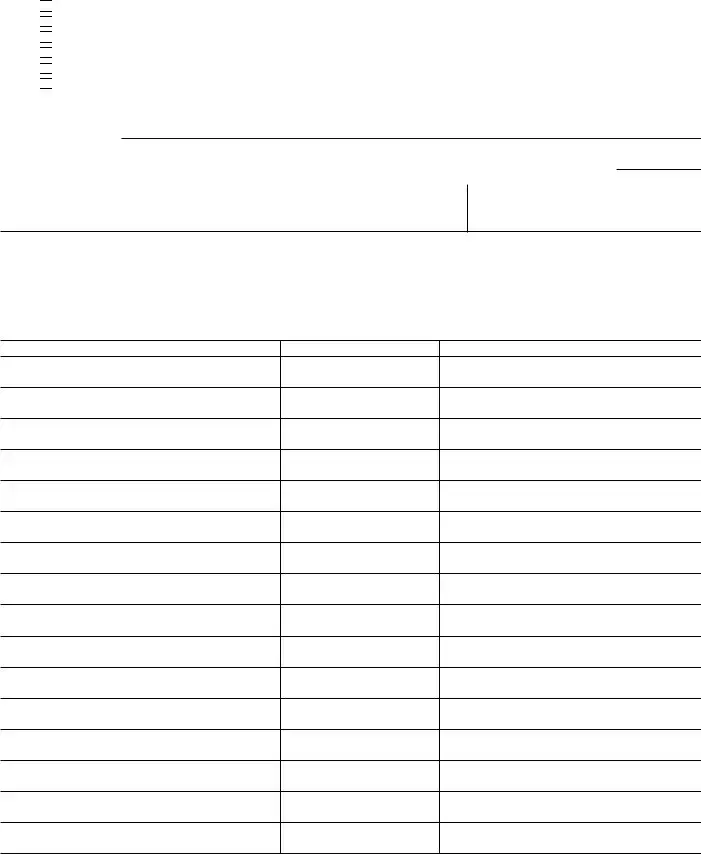

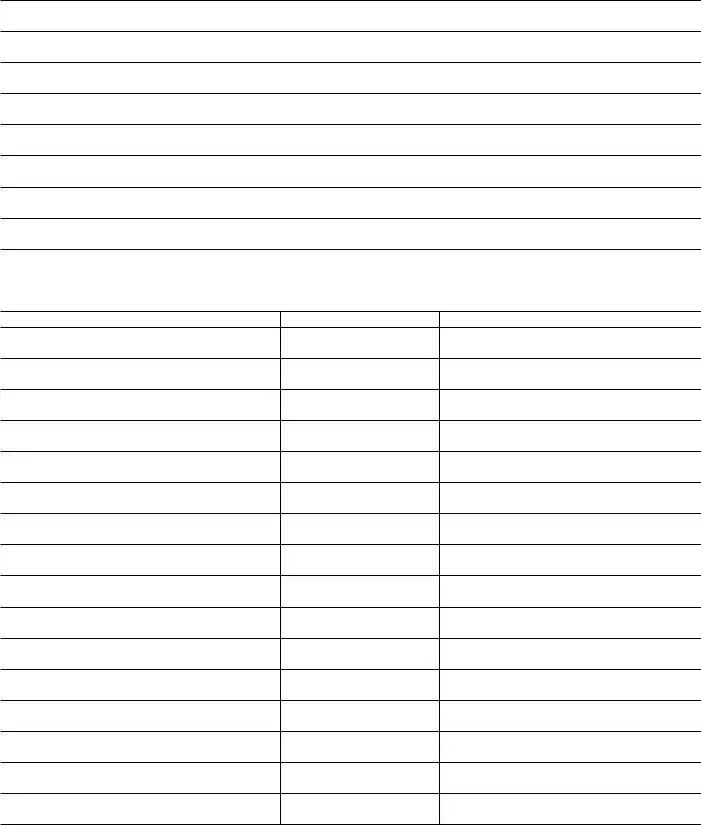

Foreign Entities Classified as Corporations for Federal Tax Purposes:

American Samoa—Corporation

Argentina—Sociedad Anonima

Australia—Public Limited Company

Austria—Aktiengesellschaft

Barbados—Limited Company

Belgium—Societe Anonyme

Belize—Public Limited Company

Bolivia—Sociedad Anonima

Brazil—Sociedade Anonima

Bulgaria—Aktsionerno Druzhestvo

Canada—Corporation and Company

Chile—Sociedad Anonima

People’s Republic of China—Gufen

Youxian Gongsi

Republic of China (Taiwan)

—Ku-fen Yu-hsien Kung-szu

Colombia—Sociedad Anonima

Costa Rica—Sociedad Anonima Croatia—Dionicko Drustvo Cyprus—Public Limited Company Czech Republic—Akciova Spolecnost Denmark—Aktieselskab Ecuador—Sociedad Anonima or Compania

Anonima

Egypt—Sharikat Al-Mossahamah

El Salvador—Sociedad Anonima

Estonia—Aktsiaselts

European Economic Area/European Union

—Societas Europaea

Finland—Julkinen Osakeyhtio/Publikt Aktiebolag

France—Societe Anonyme

Germany—Aktiengesellschaft

Greece—Anonymos Etairia

Guam—Corporation

Guatemala—Sociedad Anonima

Guyana—Public Limited Company

Honduras—Sociedad Anonima

Hong Kong—Public Limited Company

Hungary—Reszvenytarsasag

Iceland—Hlutafelag

India—Public Limited Company Indonesia—Perseroan Terbuka Ireland—Public Limited Company Israel—Public Limited Company Italy—Societa per Azioni Jamaica—Public Limited Company Japan—Kabushiki Kaisha Kazakstan—Ashyk Aktsionerlik Kogham Republic of Korea—Chusik Hoesa Latvia—Akciju Sabiedriba Liberia—Corporation Liechtenstein—Aktiengesellschaft Lithuania—Akcine Bendroves Luxembourg—Societe Anonyme Malaysia—Berhad

Malta—Public Limited Company

Mexico—Sociedad Anonima

Morocco—Societe Anonyme

Netherlands—Naamloze Vennootschap

New Zealand—Limited Company

Nicaragua—Compania Anonima

Nigeria—Public Limited Company

Northern Mariana Islands—Corporation

Norway—Allment Aksjeselskap

Pakistan—Public Limited Company

Panama—Sociedad Anonima

Paraguay—Sociedad Anonima

Peru—Sociedad Anonima

Philippines—Stock Corporation

Poland—Spolka Akcyjna

Portugal—Sociedade Anonima

Puerto Rico—Corporation

Romania—Societe pe Actiuni

Russia—Otkrytoye Aktsionernoy

Obshchestvo

Saudi Arabia—Sharikat Al-Mossahamah

Singapore—Public Limited Company

Slovak Republic—Akciova Spolocnost

Slovenia—Delniska Druzba

South Africa—Public Limited Company

Spain—Sociedad Anonima

Surinam—Naamloze Vennootschap

Sweden—Publika Aktiebolag

Switzerland— Aktiengesellschaft

Thailand—Borisat Chamkad (Mahachon)

Trinidad and Tobago—Limited Company

Tunisia—Societe Anonyme

Turkey—Anonim Sirket

Ukraine—Aktsionerne Tovaristvo Vidkritogo Tipu

United Kingdom—Public Limited Company

United States Virgin Islands—Corporation Uruguay—Sociedad Anonima Venezuela—Sociedad Anonima or Compania

Anonima

See Regulations section F! 301.7701-2(b)(8) for any

exceptions and inclusions to items CAUTION on this list and for any revisions made to this list since these instructions were printed.

Paperwork Reduction Act Notice

We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is:

Recordkeeping . . . . 2 hr., 46 min.

Learning about the

law or the form . . . . 3 hr., 48 min.

Preparing and sending

the form to the IRS . . . . . 36 min.

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. You can write to the Internal Revenue Service, Tax Forms and Publications, SE:W:CAR:MP:TFP,

1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Do not send the form to this address. Instead, see Where To File above.