500- NOL (Rev. 12/31/20)

General Instructions

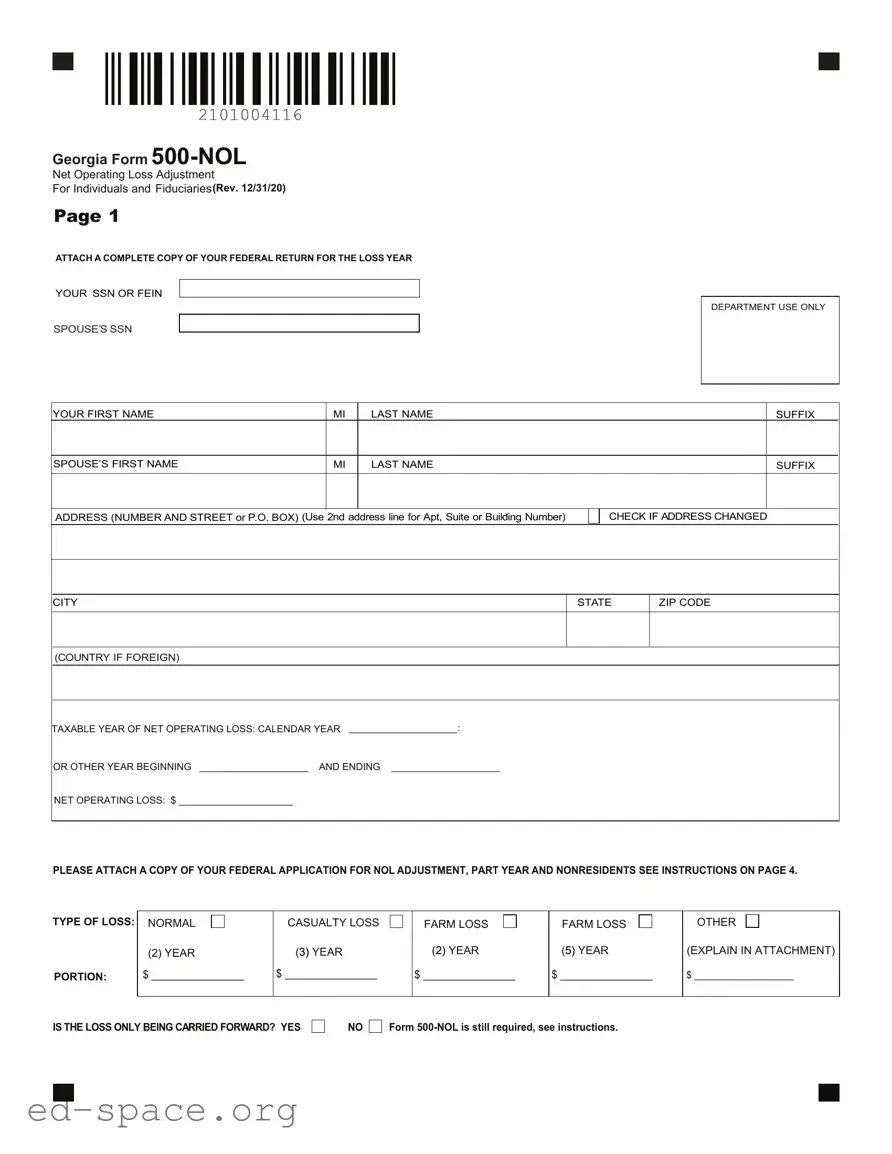

A net operating loss carryback adjustment may be filed on this form by an individual or fiduciary taxpayer that desires a refund of taxes afforded by carryback of a net operating loss. This form must be filed no later than 3 years from the due date of the loss year income tax return, including any extensions which have been granted. Form 500X should not be used to carryback a NOL Form 500-NOL must also be filed by the due date (including extensions) of the loss year return, when the taxpayer only carries the loss forward. This is necessary so the NOL can be established in the Department’s system. Page 2 carryback schedule should be left blank.

Generally a net operating loss must be carried back (if applicable) and forward

in the procedural sequence of taxable |

periods provided by Section 172 |

of the Internal Revenue Code of 1986, |

as defined in Code Section |

48-1-2. For taxable years ending on or before December 31, 2017, generally

the carryback period is 2 |

years (with special |

rules |

for farmers |

(5 |

years), |

casualty losses |

(3 years); specified |

liability |

loss (10 |

years), |

small |

business loss attributable to federally declared |

disasters |

(3 |

years); |

etc.) For losses incurred in taxable years ending after December 31, 2017, there is no carryback (with a 2 year carryback for farmers) and unlimited carryover. Also, Georgia does not follow the following federal provisions:

Special carryback rules enacted in 2009.

Special rules relating to Gulf Opportunity Zone public utility casualty losses, I.R.C. Section 1400N(j).

5 year carryback of NOLs attributable to Gulf Opportunity Zone losses, I.R.C. Section 1400N(k).

5 year carryback of NOLs incurred in the Kansas disaster area after May 3, 2007, I.R.C. Section 1400N(k).

5 year carryback of certain disaster losses, I.R.C. Sections 172(b)(1)(J) and 172(j).

The election to deduct public utility property losses attributable to May 4, 2007 Kansas storms and tornadoes in the fifth tax year before the year of the loss, I.R.C. Section 1400N(o).

For losses incurred in taxable years beginning on or after January 1, 2018, the net operating loss cannot offset more than 80% of Georgia taxable net income.

Within 90 days from the last day of the month in which this form is filed, the Commissioner of Revenue shall make a limited examination of the form and disallow without further action any form containing errors of computation not correctable within such 90-day period or having material omissions. A decrease of tax determined for prior year tax will first be credited against any unpaid tax and any remaining balance will be refunded to the taxpayer without interest within the 90-day period.

*Note: This form shall constitute a claim for credit or refund.

If the commissioner should determine that the amount credited or refunded by an application is in excess of the amount properly attributable to the carry- back with respect to which such amount was credited or refunded, the commissioner may assess the amount of the excess as a deficiency as if it were due to a mathematical error appearing on the face of the return.

What to attach:

1.Copy of Federal Application for Net Operating Loss.

2.Copy of Federal return for the loss year that includes pages 1 and 2, schedules 1, A, D, and E.

3.Copy of Federal returns for the carryback years that includes pages 1 and 2, Schedule 1 and Schedule A and any schedules that were recalculated in carry- back year.

4.Copy of Georgia returns for the carryback or carryforward years

5.Copy of Georgia form 500 for the lossyear.

Be sure to attach all required forms listed above and complete all lines of the Form 500-NOL that apply. Otherwise your application may be disallowed.

The carryback period may be foregone and the NOL carried forward. Election: A taxpayer is bound by the Federal election to forego the carryback period. A copy of this election should be attached to the Georgia return. If there is a Georgia NOL but no Federal NOL, the taxpayer may make an election “for Georgia purposes only” under the same rules and restrictions as the Federal election. The Form 500-NOL should be filed even when the carryback period is foregone.

Example: A taxpayer has a large Net Operating Loss in 1998 (both Federal and Georgia). With his timely filed Federal return, he includes a statement that he elects to forgo the carryback period. He must therefore carry his Georgia (as well as his Federal) NOL forward without first carrying it back. Any portion not absorbed after 20 years is lost.

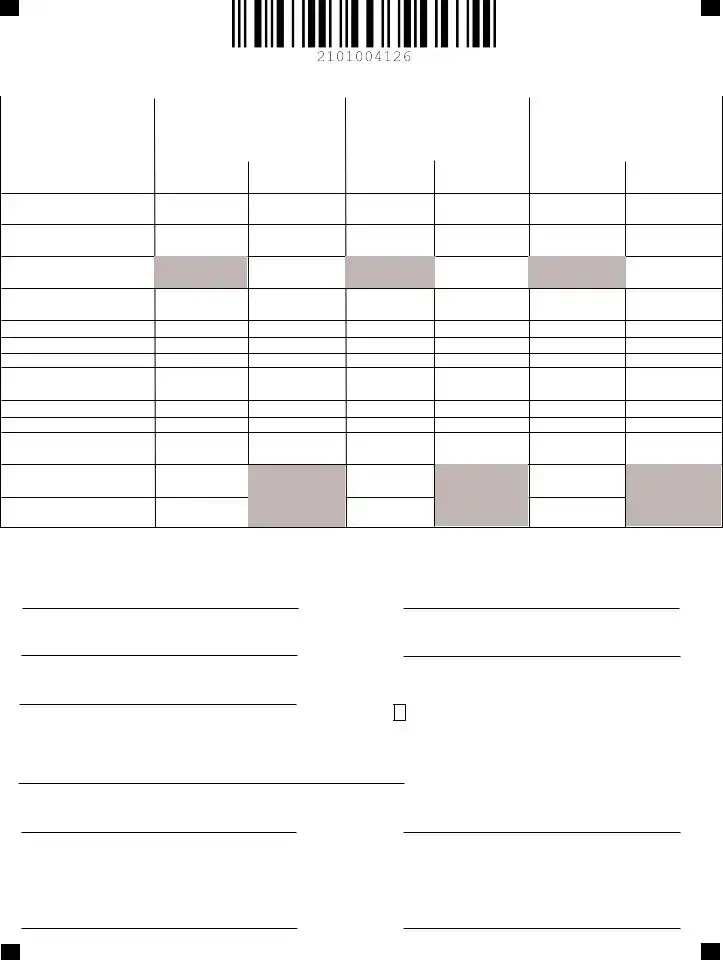

Page 2 Instructions

Columns a, c, and e.

Enter the amounts from your original return or as previously adjusted by you or the Department of Revenue.

Columns b, d, and f.

Lines 1 and 5, enter the amounts after adjustments that are required by I.R.C. Section 172, if any. Line 1 should not be reduced by the Federal or Georgia NOL.

Lines 2 and 7, enter the amounts from your original return or as previously adjusted by you or the Department of Revenue.

Line 3. For the earliest carryback year, in column (b) enter the NOL from page 3, line

41.In column (d) and (f) if applicable, enter the amount from line 9 of the Net Operating Loss Carryover schedule on page 4. For example, a taxpayer has a oss from 2013 which has a two year carryback period. The loss from page 3 line 41 s listed on line 3 in column (b) for 2011. Not all of the loss is utilized. The taxpayer makes the adjustments as required for 2011 in the Net Operating Loss Carryover schedule on page 4 and lists the amount from line 9 (if it is a positive amount) on ine 3 in column (d) for 2012.

Line 10, the credit for taxes paid to other states should be recomputed based on the new Georgia AGI and deductions. Other credits that are based on liability should be adjusted accordingly. Any credits that are not allowed and that are eligible for carry- forward can be carried forward. Do not enter more than Line 9.

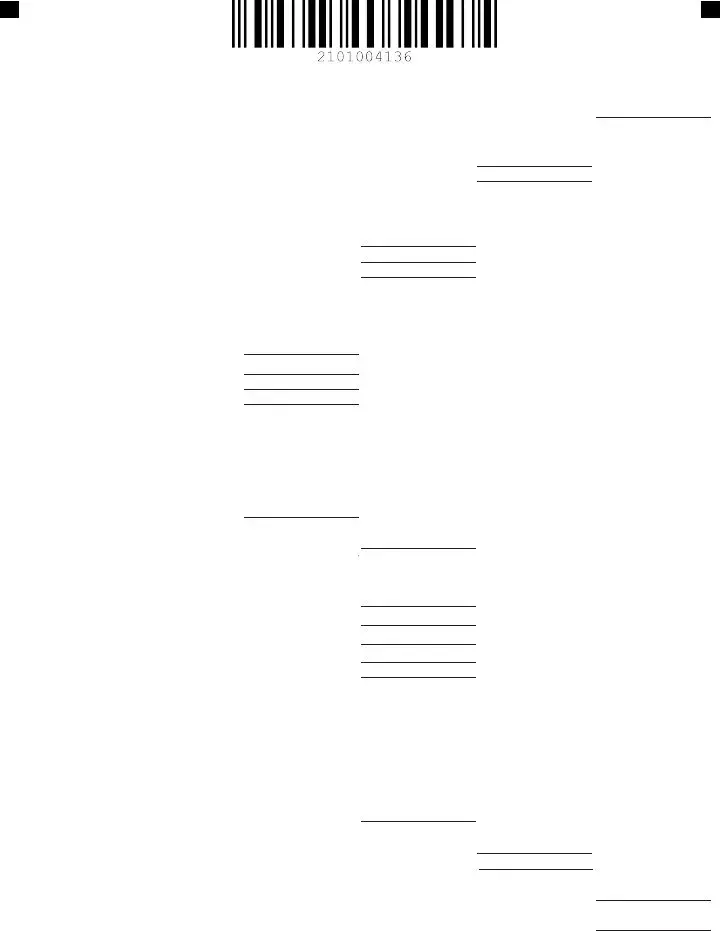

Page 3 Instructions

A Georgia Net Operating Loss (NOL) must be computed separately from any Federal NOL. It is possible to have a Federal NOL, but not a Georgia NOL.

Line 21. In computing a Georgia NOL only Georgia amounts can be used. Interest on U.S. savings bonds should be entered as a negative number on this line. Non- Georgia municipal interest should be entered as a positive number on this line. The nonbusiness portion of the retirement exclusion should be entered as a negative number on this line. This should be computed as follows. The total nonbusiness income (as it is defined for NOL purposes) that is included in the retirement exclusion should be divided by the total income that is included in the retirement exclusion. This percentage should then be multiplied by the retirement exclusion. For example, if the taxpayer has $8,000 in wages and $20,000 in interest income, the taxpayer would divide $20,000 by $28,000 and then multiply this by the retirement exclusion amount. When computing the percentage, the following guidelines should be followed:

1.If the total nonbusiness income that is included in the retirement exclusion is zero or less than zero, the percentage is zero. This would apply even if the total income that is included in the retirement exclusion is zero or less than zero.

2.If the total nonbusiness income that is included in the retirement exclusion is greater than zero and exceeds the total income that is included in the retirement exclusion, the percentage is 100%. This would apply even if the total income that is included in the retirement exclusion is zero or less than zero.

Additionally, in situations where two people file married filing joint, a separate computation should be made to determine each taxpayer’s portion of the retirement exclusion that is related to nonbusiness income.

Line 42. Georgia follows the I.RC. Section 461(l) loss limitation. However, before the I.RC. Section 461(l) loss limitation is applied, the business should compute the business income and deductions pursuant to the I.R.C. as defined for Georgia purposes (with the I.R.C. section 168(k) disallowance, etc.). Then the 461(l) provisions should be applied. The 461(l) loss that is disallowed and is eligible to be carried forward should be entered on line 42. This amount must be included when the 500- NOL is filed to establish the NOL on the Department’s systems so the NOL will be available when subsequent year returns are filed.

Page 4 Instructions

Net Operating Loss Carryover

1.A Georgia Net Operating Loss (NOL) carryover must be computed separately from any Federal NOL carryover. It is possible to have a Federal NOL carryover but not a Georgia NOL carryover.

2.Line 3, enter as a positive number the adjustment as required by I.R.C. Section 172, if it applies.

3.Line 4, enter as a positive number the gain excluded under I.R.C. section 1202 on the sale or exchange of qualified small business stock, if it applies.

4.Lines 5 and 6, enter the adjustments that are required by I.R.C. Section 172, if any.

5.Line 9, if the 80% limitation applied to the year the loss was carried to,

an additional adjustment must be made before entering the loss on either the carryover year on page 2 or the carryover year after the loss year. After computing the amount on line 9, add the difference between the taxable income before NOL carryback on line 2 and the NOL actually used considering the 80% limitation. For example, the taxpayer has a 2019 NOL of 200,000. Their taxable income in 2020 is 100,000 (they used 80,000 of the NOL after considering the

80% rule) and that $100,000 is entered on line 2 of the schedule at the top of page 4. For simplicity sake assume the only adjustment that is required on the top of page 4 are exemptions of 7,400 and that is entered on line 7.

Therefore |

the modified taxable |

income on line 8 |

is 107,400. Subtracting |

the 107,400 from the 200,000 results in 92,600 being entered on line 9. |

The |

difference |

of the 100,000 line |

2 amount and the |

80,000 is 20,000. |

This |

would be added to the 92,600 and therefore 112,600 is available to be carried to 2021.