D

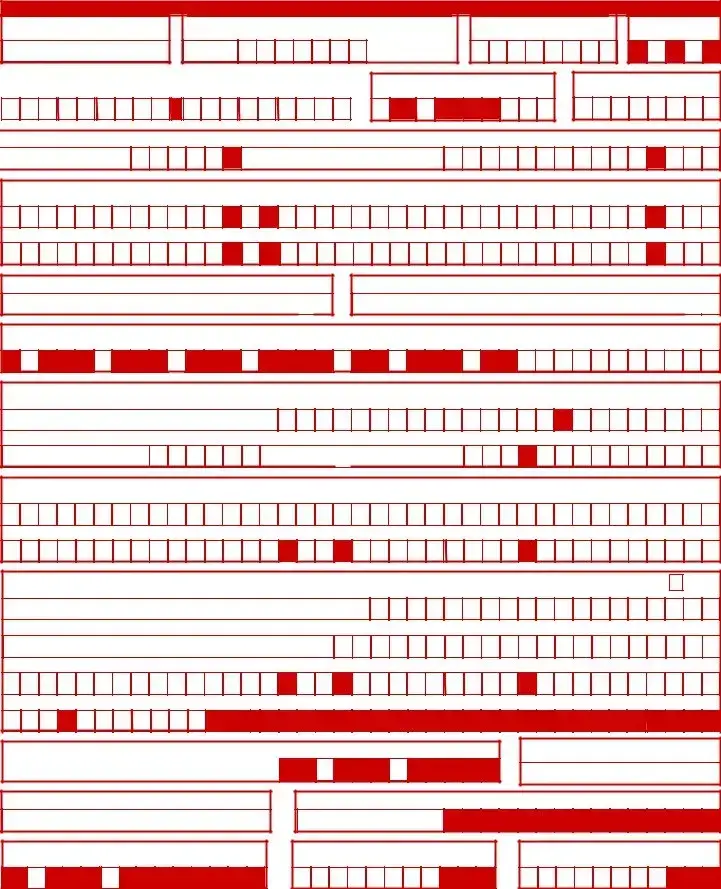

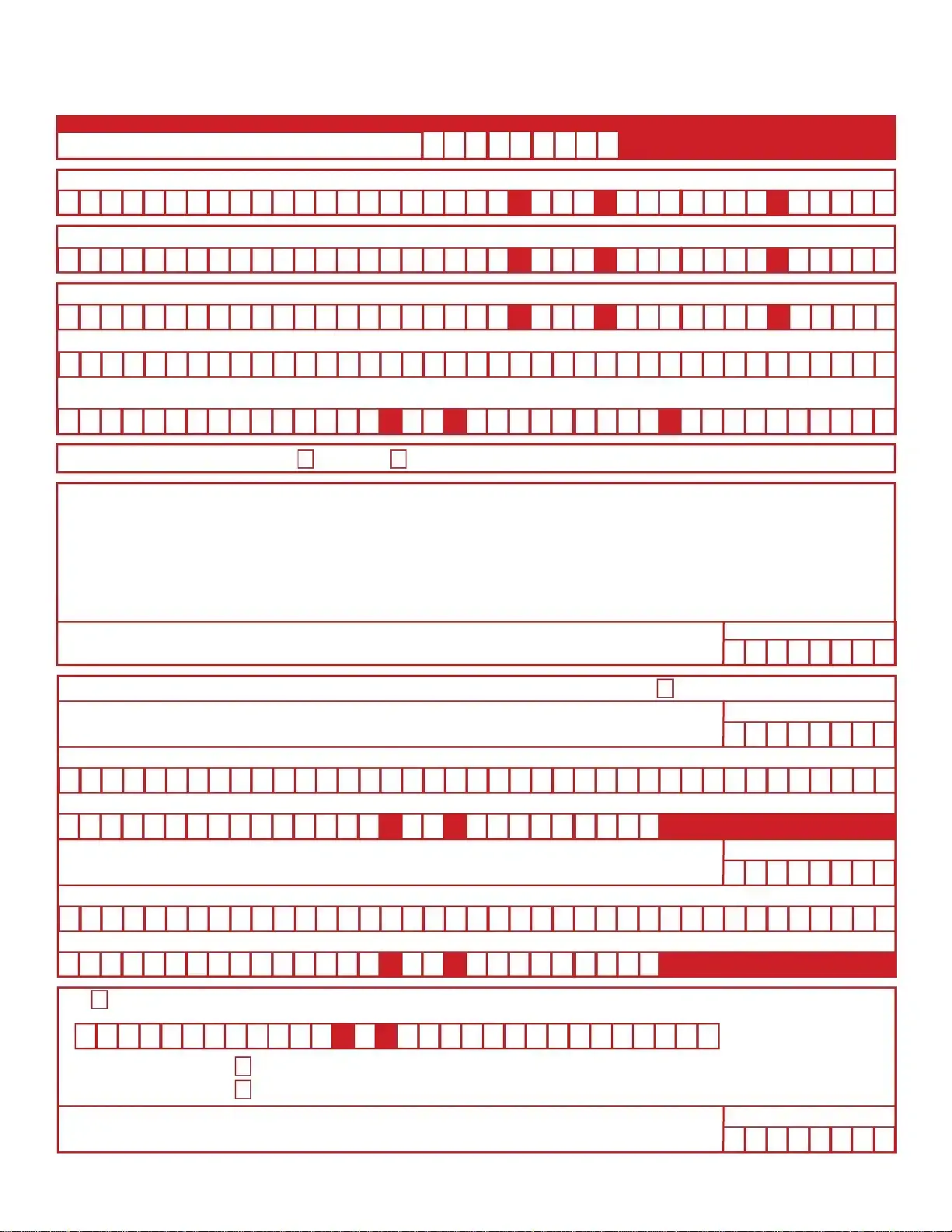

E 2501 Rev. 82 (10-24) (INTERNET) Instruction & Information B

Basic Eligibility

To be eligible for disability benefits, you must:

•

Be unable to do your regular work for at least eight consecutive days.

•

Be employed or actively looking for work when your disability began.

•

Have lost wages because of your disability. If unemployed,

you must have been actively looking for work.

•

Have earned at least $300 from which State Disability Insurance

(SDI) deductions were withheld during the past 5 to 18 months.

See “Your Benefit Amounts” in the next column.

•

Be under the care and treatment of a licensed health professional

during the first eight days of your disability. The start date of your

claim can be adjusted to meet this requirement. You must remain

under care and treatment to continue receiving benefits.

•

Submit your application within 49 days of the date your disability

began or you may lose benefits.

Your licensed health professional must complete the medical

certification of your disability. A licensed midwife or nurse-midwife

can complete the medical certification for disabilities related to normal

pregnancy or childbirth.

If you’re under the care of a religious practitioner, they must

complete and sign the Claim for Disability Insurance Benefits –

Religious Practitioner’s Certificate (DE 2502). To get the DE 2502,

call 1-800-480-3287. Certification by a religious practitioner is

acceptable only if the practitioner has been accredited by the EDD.

We may need an independent medical examination to determine

your eligibility.

Ineligibility

Apply for benefits even if you’re not sure you’re eligible. If we find

you ineligible for all or part of your claim, we will let you know.

You may not be eligible if:

•

You’re claiming or receiving unemployment or Paid Family Leave

benefits.

•

Your disability began while committing a crime resulting in a

felony conviction.

•

You’re receiving Workers’ Compensation benefits at a weekly rate

equal to or greater than the disability rate.

•

You’re in jail or prison because you were convicted of a crime.

•

You’re a resident in an alcoholic recovery home or drug-free

residential facility that is not licensed and certified by the state.

•

You do not submit to an independent medical examination, if

requested.

Fraud

Making false statements or withholding information to receive benefit

payments is a felony. Penalties may include fines, a loss of benefits,

and criminal prosecution. To detect and discourage fraud, we monitor

claims, investigate suspicious activity, and seek restitution and

conviction through prosecution (CUIC, sections 2101, 2116, and 2122).

Your Responsibilities

•

Submit your application within 49 days of the date your disability

began. If your application is late, include a written explanation of

why it’s late.

•

Read the instructions on all forms you receive from us. If you’re

not sure about what you need to do, contact a disability office

(edd.ca.gov/Office_Locator).

•

You must let us know in writing, through SDI Online, or by phone if you:

Change your address or phone number.

Return to part-time or full-time work.

Recover from your disability.

Receive any type of income.

Keep an appointment for an independent medical examination, if

requested.

•

Include your name and Social Security number used to obtain

benefits or Claim ID number on all correspondence.

Your Rights

Information about your claim is confidential, except for the purposes

allowed by law. You have the right to inspect any personal records we

have about you and ask that we correct our records if you believe they

are not accurate, relevant, timely, or complete (Civil Code, section

1798.34, and 1798.35).

Certain types of information are exempt from disclosure to you:

•

Medical or psychological records where knowledge of the contents

might be harmful to the subject.

•

Records of active criminal, civil, or administrative investigations.

If you’re denied access to records that you believe you have a right to

inspect, or if your request to amend your records is refused, you may

file an appeal with an SDI office. You may request a copy of your file by

calling us at 1-800-480-3287 (Civil Code, section 1798.40).

You also have the right to appeal any disqualification, overpayment,

or penalty. Instructions on how to appeal are provided on documents

that can be appealed. If you file an appeal and your disability continues,

you must complete and return continued claim certifications.

Your Benefit Amounts — Generally, your claim begins on the date your

disability begins. The first day you cannot do your regular work is the

date your disability begins.

We calculate your weekly benefit amount using your base period. The

date your disability begins determines your base period unless we

adjust the claim effective date. If you want your claim to begin later so

that you will have a different base period, call 1-800-480-3287 before

you submit your application.

Your base period covers 12 months and is divided into four consecutive

quarters. It includes wages subject to SDI tax that you were paid about

5 to 18 months before your disability claim began. Your base period

does not include wages being paid at the time the disability began.

Use the following information to determine your base period.

•

If your claim begins in January, February, or March, your base period

is the 12 months ending last September 30.

•

If your claim begins in April, May, or June, your base period is the 12

months ending last December 31.

•

If your claim begins in July, August, or September, your base period

is the 12 months ending last March 31.

•

If your claim begins in October, November, or December, your base

period is the 12 months ending last June 30.

Your highest-earning quarter determines your weekly benefit amount.

You may not change the start date of your claim or adjust your base

period after you have established a valid claim.

Your daily benefit amount is your weekly benefit amount divided by

seven. Your maximum benefit amount is 52 times your weekly benefit

amount or the total wages subject to SDI tax paid in your base period,

whichever is less. Exceptions are:

•

For employers and self-employed individuals who elect SDI coverage,

the maximum benefit amount is 39 times the weekly rate.

•

For residents in a state licensed and certified alcoholic recovery

home or drug-free residential facility, the maximum payable period

is 90 days. However, disabilities related to or caused by acute or

chronic alcoholism or drug abuse that are being medically treated

do not have this limitation.

Contact a disability office (edd.ca.gov/Office_Locator) for more

information if:

•

You do not have sufficient base period wages and your disability

continues. You may be able to use a later start date on your claim.

•

You do not have enough base period wages and you were actively

seeking work for 60 days or more in any quarter of the base period.

You may be able to substitute wages paid in prior quarters.

•

During your base period you were in the US military service,

received Workers’ Compensation benefits, or did not work

because of a labor dispute. You may be entitled to substitute

wages paid in prior quarters either to make your claim valid or

to increase your benefit amount.