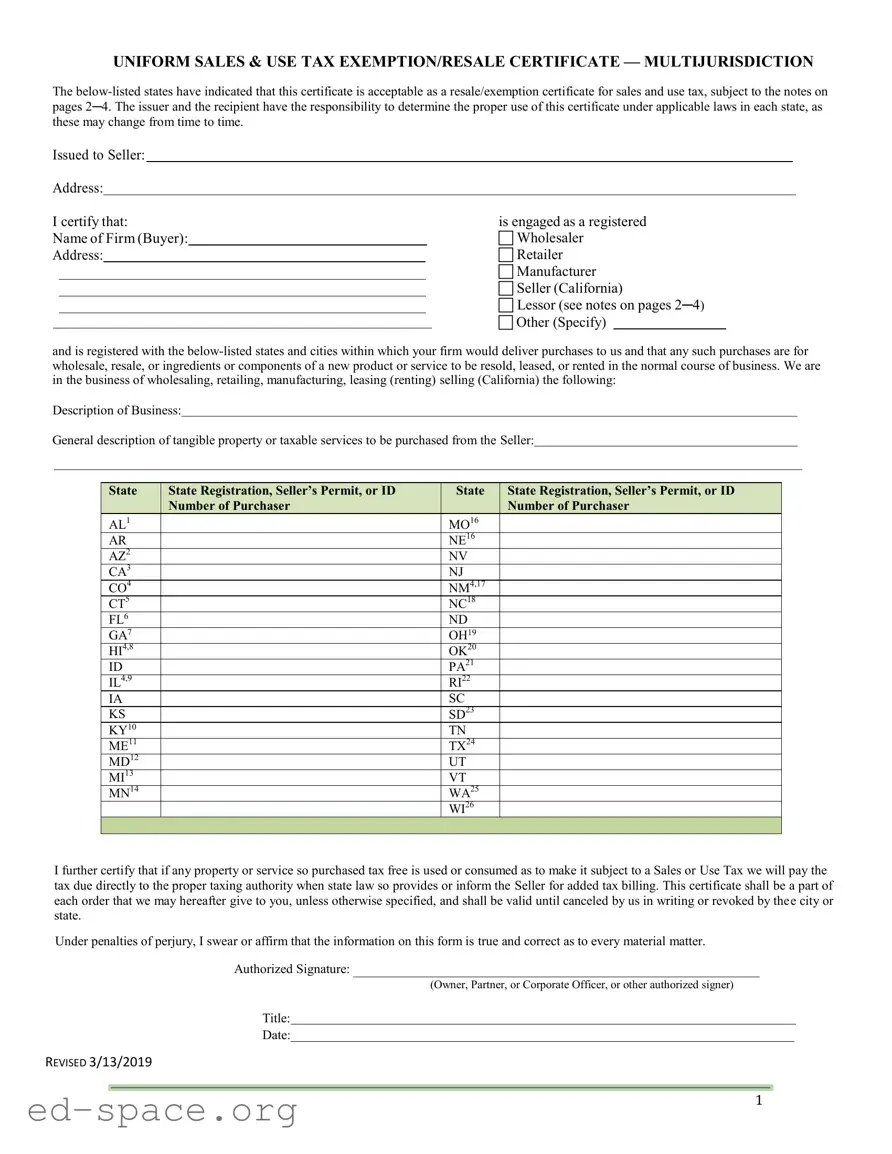

UNIFORM SALES & USE TAX EXEMPTION/RESALE CERTIFICATE — MULTIJURISDICTION

The below-listed states have indicated that this certificate is acceptable as a resale/exemption certificate for sales and use tax, subject to the notes on pages 2─4. The issuer and the recipient have the responsibility to determine the proper use of this certificate under applicable laws in each state, as these may change from time to time.

Issued to Seller:

Address:

I certify that: |

|

|

is engaged as a registered |

Name of Firm (Buyer): |

|

|

|

Wholesaler |

Address: |

|

|

Retailer |

|

|

|

|

|

|

Manufacturer |

|

|

|

|

|

|

Seller (California) |

|

|

|

|

|

|

Lessor (see notes on pages 2─4) |

|

|

|

|

|

|

Other (Specify) |

|

and is registered with the below-listed states and cities within which your firm would deliver purchases to us and that any such purchases are for wholesale, resale, or ingredients or components of a new product or service to be resold, leased, or rented in the normal course of business. We are in the business of wholesaling, retailing, manufacturing, leasing (renting) selling (California) the following:

Description of Business:

General description of tangible property or taxable services to be purchased from the Seller:

State |

State Registration, Seller’s Permit, or ID |

State |

State Registration, Seller’s Permit, or ID |

|

Number of Purchaser |

|

Number of Purchaser |

AL1 |

|

MO16 |

|

AR |

|

NE16 |

|

AZ2 |

|

NV |

|

CA3 |

|

NJ |

|

CO4 |

|

NM4,17 |

|

CT5 |

|

NC18 |

|

FL6 |

|

ND |

|

GA7 |

|

OH19 |

|

HI4,8 |

|

OK20 |

|

ID |

|

PA21 |

|

IL4,9 |

|

RI22 |

|

IA |

|

SC |

|

KS |

|

SD23 |

|

KY10 |

|

TN |

|

ME11 |

|

TX24 |

|

MD12 |

|

UT |

|

MI13 |

|

VT |

|

MN14 |

|

WA25 |

|

|

|

WI26 |

|

|

|

|

|

I further certify that if any property or service so purchased tax free is used or consumed as to make it subject to a Sales or Use Tax we will pay the tax due directly to the proper taxing authority when state law so provides or inform the Seller for added tax billing. This certificate shall be a part of each order that we may hereafter give to you, unless otherwise specified, and shall be valid until canceled by us in writing or revoked by thee city or state.

Under penalties of perjury, I swear or affirm that the information on this form is true and correct as to every material matter.

Authorized Signature:

(Owner, Partner, or Corporate Officer, or other authorized signer)

Title:

Date:

REVISED 3/13/2019

INSTRUCTIONS REGARDING

UNIFORM SALES & USE TAX EXEMPTION CERTIFICATE

To Seller’s Customers:

In order to comply with most state and local sales tax law requirements, the Seller must have in its files a properly executed exemption certificate from all of its customers (Buyers) who claim a sales/use tax exemption. If the Seller does not have this certificate, it is obliged to collect the tax for the state in which the property or service is delivered.

If the Buyer is entitled to a sales tax exemption, the Buyer should complete the certificate and send it to the Seller at its earliest convenience. If the Buyer purchases tax free for a reason for which this form does not provide, the Buyer should send the Seller its special certificate or statement.

Caution to Seller:

In order for the certificate to be accepted in good faith by the Seller, Seller must exercise care that the property or service being sold is of a type normally sold wholesale, resold, leased, rented, or incorporated as an ingredient or component of a product manufactured by Buyer and then resold in the usual course of its business. A Seller failing to exercise care could be held liable for the sales tax due in some states or cities. Misuse of this certificate by Seller, lessee, or the representative thereof may be punishable by fine, imprisonment or loss of right to issue a certificate in some states or cities.

Notes:

1.Alabama: Each retailer shall be responsible for determining the validity of a purchaser’s claim for exemption.

2.Arizona: This certificate may be used only when making purchases of tangible personal property for resale in the ordinary

course of business, and not for any other statutory deduction or exemption. It is valid as a resale certificate only if it contains the purchaser’s name, address, signature, and Arizona transaction privilege tax (or other state sales tax) license number, as required by Arizona Revised Statutes § 42-5022, Burden of proving sales not at retail.

3. California: a) This certificate is not valid as an exemption certificate. Its use is limited to use as a resale certificate subject to the provisions of Title 18, California Code of Regulations, Section 1668 (Sales and Use Tax Regulation 1668, Resale Certificate).

b)By use of this certificate, the purchaser certifies that the property is purchased for resale in the regular course of business in the form of tangible personal property, which includes property incorporated as an ingredient or component of an item manufactured for resale in the regular course of business.

c)When the applicable tax would be sales tax, it is the Seller who owes that tax unless the Seller takes a timely and valid resale certificate in good faith.

d)A valid resale certificate is effective until the issuer revokes the certificate.

4.Colorado, Hawaii, Illinois, and New Mexico: these states do not permit the use of this certificate to claim a resale exemption for the purchase of a taxable service for resale.

5.Connecticut: This certificate is not valid as an exemption certificate. Its use is limited to use as a resale certificate subject to Conn. Gen. State §§12-410(5) and 12-411(14) and regulations and administrative pronouncements pertaining to resale certificates.

6.Florida: Allows the Multistate Tax Commission’s Uniform Sales and Use Tax Exemption/Resale Certificate –

Multijurisdictional for tax-exempt purchases for resale; however, the selling dealer must also obtain a resale authorization

number from the Florida Department of Revenue at floridarevenue.com/taxes/certificates, or by calling 877-357-3725, and entering the purchaser’s Florida Annual Resale Certificate number.

7.Georgia: The purchaser’s state-of-registration number will be accepted in lieu of Georgia’s registration number when the

purchaser is located outside Georgia, does not have nexus with Georgia, and the tangible personal property is delivered by drop shipment to the purchaser’s customer located in Georgia.

REVISED 3/13/2019

8.Hawaii: allows this certificate to be used by the seller to claim a lower general excise tax rate or no general excise tax, rather than the buyer claiming an exemption. The no tax situation occurs when the purchaser of imported goods certifies to the seller, who originally imported the goods into Hawaii, that the purchaser will resell the imported goods at wholesale. If the lower rate or no-tax does not in fact apply to the sale, the purchaser is liable to pay the seller the additional tax imposed. See Hawaii Dept. of Taxation Tax Information Release No. 93-5, November 10, 1993, and Tax Information Release No. 98-8, October 30, 1998.

9.Illinois: Use of this certificate in Illinois is subject to the provisions of 86 Ill. Adm. Code Ch.I, Sec. 130.1405. Illinois does not have an exemption for sales of property for subsequent lease or rental, nor does the use of this certificate for claiming resale purchases of services have any application in Illinois.

The registration number to be supplied next to Illinois on page 1 of this certificate must be the Illinois registration or resale number; no other state’s registration number is acceptable.

“Good faith” is not the standard of care to be exercised by a retailer in Illinois. A retailer in Illinois is not required to determine whether the purchaser actually intends to resell the item. Instead, a retailer must confirm that the purchaser has a valid registration or resale number at the time of purchase. If a purchaser fails to provide a certificate of resale at the time of sale in Illinois, the seller must charge the purchaser tax.

While there is no statutory requirement that blanket certificates of resale be renewed at certain intervals, blanket certificates should be updated periodically, and no less frequently than every three years.

10.Kentucky: a) Kentucky does not permit the use of this certificate to claim resale exclusion for the purchase of a taxable service.

b)This certificate is not valid as an exemption certificate. Its use is limited to use as a resale certificate subject to the provisions of Kentucky Revised Statute 139.270 (Good Faith).

c)The use of this certificate by the purchaser constitutes the issuance of a blanket certificate in accordance with Kentucky Administrative Regulation 103 KAR 31:111.

11.Maine: This state does not have an exemption for sales of property for subsequent lease or rental.

12.Maryland: This certificate is not valid as an exemption certificate. However, vendors may accept resale certificates that bear the

exemption number issued to a religious organization. Exemption certifications issued to religious organizations consist of 8 digits, the first two of which are always “29”. Maryland registration, exemption, and direct pay numbers may be verified on the website of the Comptroller of the Treasury at www.marylandtaxes.com.

13.Michigan: This certificate is effective for a period of four years unless a lesser period is mutually agreed to and stated on this certificate. It covers all exempt transfers when accepted by the seller in “good faith” as defined by Michigan statute.

14.Minnesota: a) Minnesota does not allow a resale certificate for purchases of taxable services for resale in most situations.

b)Minnesota allows an exemption for items used only once during production and not used again.

15. |

Missouri: |

a) Purchasers who improperly purchase property or services sales-tax free using this certificate may be required to |

|

|

pay the tax, interest, additions to tax, or penalty. |

b)Even if property is delivered outside Missouri, facts and circumstances may subject it to Missouri tax, contrary to the second sentence of the first paragraph of the above instructions.

16. Nebraska: A blanket certificate is valid for 3 years from the date of issuance.

17.New Mexico: For transactions occurring on or after July 1, 1998, New Mexico will accept this certificate in lieu of a New Mexico nontaxable transaction certificate and as evidence of the deductibility of a sale of tangible personal property provided:

a)this certificate was not issued by the State of New Mexico;

b)the buyer is not required to be registered in New Mexico; and

c)the buyer is purchasing tangible personal property for resale or incorporation as an ingredient or component of a manufactured product.

18.North Carolina: This certificate is not valid as an exemption certificate if signed by a person such as a contractor who intends to use the property. Its use is subject to G.S. 105-164.28 and any administrative rules or directives pertaining to resale certificates.

REVISED 3/13/2019

19. Ohio: a) The buyer must specify which one of the reasons for exemption on the certificate applies. This may be done by circling or underlining the appropriate reason or writing it on the form above the state registration section. Failure to specify the exemption reason will, on audit, result in disallowance of the certificate.

b)In order to be valid, the buyer must sign and deliver the certificate to the seller before or during the period for filing the return.

20Oklahoma: Oklahoma would allow this certificate in lieu of a copy of the purchaser’s sales tax permit as one of the elements of “properly completed documents” which is one of the three requirements which must be met prior to the vendor being relieved of liability. The other two requirements are that the vendor must have the certificate in his possession at the time the sale is made and must accept the documentation in good faith. The specific documentation required under OAC 710-:65-7-6 is:

a)Sales tax permit information may consist of:

(i)A copy of the purchaser’s sales tax permit; or

(ii)In lieu of a copy of the permit, obtain the following:

*Sales tax permit number; and

*The name and address of the purchaser;

b)A statement that the purchaser is engaged in the business of reselling the articles purchased;

c)A statement that the articles purchased is purchased for resale;

d)The signature of the purchaser or a person authorized to legally bind the purchaser; and

e)Certification on the face of the invoice, bill, or sales slip, or on separate letter, that said purchaser is engaged in reselling the articles purchased.

Absent strict compliance with these requirements, Oklahoma holds a seller liable for sales tax due on sales where the claimed exemption is found to be invalid, for whatever reason, unless the Tax Commission determines that purchaser should be pursued for collection of the tax resulting from improper presentation of a certificate.

21.Pennsylvania: This certificate is not valid as an exemption certificate. It is valid as a resale certificate only if it contains the purchaser’s Pennsylvania Sales and Use Tax eight-digit license number, subject to the provisions of 61 PA Code §32.3.

22.Rhode Island: Rhode Island allows this certificate to be used to claim a resale exemption only when the item will be resold in the same form. It does not permit this certificate to be used to claim any other type of exemption.

23.South Dakota: Services which are purchased by a service provider and delivered to a current customer in conjunction with the services contracted to be provided to the customer are claimed to be for resale. Receipts from the sale of a service for resalele by the purchaser are not subject to sales tax if the purchaser furnishes a resale certificate which the seller accepts in good faith. In order for the transaction to be a sale for resale, the following conditions must be present:

(a)The service is purchased for or on behalf of a current customer;

(b)The purchaser of the service does not use the service in any manner; and

(c)The service is delivered or resold to the customer without any alteration or change.

24..Texas: Items purchased for resale must be for resale within the geographical limits of the United States, its territories, and possessions.

25.Washington: a) Blanket resale certificates must be renewed at intervals not to exceed four years;

b)This certificate may be used to document exempt sales of “chemicals to be used in processing ann article to be produced for sale.”

c)Buyer acknowledges that the misuse of the tax due, in addition to the tax, interest, and any other penalties imposed by law.

26.Wisconsin: Wisconsin allows this certificate to be used to claim a resale exemption only. It does not permit this certificate to be used to claim any other type of exemption.

REVISED 3/13/2019

4

Frequently Asked Questions

Uniform Sales and Use Tax Certificate – Multijurisdictional

•To whom do I give this certificate?

•Can I register for multiple states simultaneously?

•I have received this certificate from my customer. What do I do with it?

•Am I the Buyer or the Seller?

•What is the purpose of this certificate?

•How do I fill out the certificate?

•What information goes on the line next to each state abbreviation?

•What if I don’t have an ID number for any (or some) state(s)?

•Who should use this certificate?

•Can I use this certificate?

•Which states accept the certificate?

•I am based in, buying from, or selling into Maine. Can I use this certificate?

•I am a drop shipper. Can I use this certificate?

•Do I have to fill this certificate out for every purchase?

•Can this certificate be used as a blanket certificate?

•Who determines whether this certificate will be accepted?

•I have been asked to accept this certificate. How do I know whether I should accept it?

•Is there a more recent version of this certificate?

•To whom should I talk to for more information?

To whom do I give this certificate?

If you are purchasing goods for resale, you will give this certificate to your vendor, so that your vendor will not charge you sales tax.

If you are selling goods for resale, and you have received this certificate from your buyer, you will keep the certificate on file.

Can I register for multiple states simultaneously?

Click on the link for more information: www.sstregister.org

I have received this certificate from my customer. What do I do with it?

Once you have examined the certificate and you have accepted it in good faith, you will keep it on file as prescribed by applicable state laws. The relevant state will generally be the state where you are located, or the state where the sales transaction took place.

Am I the Buyer or the Seller?

If you are purchasing goods for resale, you are the Buyer. If you are selling goods to a buyer who is purchasing them for resale, you are the Seller.

What is the purpose of this certificate?

This certificate is to be used as supporting documentation that the Seller should not collect sales tax because the good or service sold, or the Buyer, is exempt from the tax.

How do I fill out the certificate?

The individual filling out the certificate is referred to as the Buyer. The first two lines, “Issued to Seller” and

REVISED 3/13/2019

“Address”, should be filled in with the name and address of the Seller. The rest of the information refers to the Buyer (name and address of Buyer, business engaged in, description of business, property or services to be purchased). The line next to each state abbreviation should be filled out with the relevant state ID number.

What information goes on the line next to each state abbreviation?

The line next to each state abbreviation should be filled in with the relevant state ID number. This will be an identification number issued by the state (see next FAQ for an exception). For example, on the line next to AL, provide the ID number issued by Alabama.) The relevant ID number may be given various names in the various states. Some of the terms for this ID number are State Registration, Seller’s Permit, or ID Number. Regardless of the name, this will be a number that has been issued by the state to the Buyer (see next FAQ for an exception). This number is generally associated with the reseller’s authority to collect and remit sales tax.

What if I don’t have an ID number for any (or some) state(s)?

The states vary in their rules regarding requirements for a reseller exemption. Some states require that the reseller (Buyer) be registered to collect sales tax in the state where the reseller makes its purchase. Other states will accept the certificate if an ID number is provided for some other state (e.g., the home state of the Buyer). You should check with the relevant state to determine whether you meet the requirements of that state.

Who should use this certificate?

A Buyer who is a reseller of tangible property or taxable services from a Seller located in one of the states listed may be able to use this certificate for sales tax exemption. States vary in their policies for use of this certificate. Questions regarding your specific eligibility to use this certificate should be addressed to the revenue department of the relevant state.

Can I use this certificate?

The states vary in their rules for use of this certificate. You should check with the relevant state to determine whether you can use this certificate. The relevant state may be the state where the Seller is located, where the transaction takes place, or where the Buyer is located. The footnotes to the certificate provide some guidance; however, the Multistate Tax Commission cannot guarantee that any state will accept this certificate. States may change their policies without informing the Multistate Tax Commission.

Which states accept the certificate?

States listed on the certificate accepted this certificate as of July, 2000. States may change their policies for acceptance of the certificate without notifying the Multistate Tax Commission. You may check with the relevant state to determine the current status of the state’s acceptance policy. See next FAQ.

I am based in, buying from, or selling into Maine. Can I use this certificate?

Please contact Maine Revenue Services. See: Sales Instructional Bulletin 54

www.maine.gov/revenue/salesuse/Bull5410092013.pdf

I am a drop shipper. Can I use this certificate?

If you are the Buyer and your Seller ships directly to your customers, you may be able to use this certificate because you are a reseller. However, your Seller may be unwilling to accept this certificate if you are not registered to collect sales tax in the state(s) where your customers are located.

If you are the Seller, and you have nexus with the state(s) into which you are shipping to your Buyer’s customers, you may be required by that state(s) to remit sales tax on those sales if your Buyer is not registered to collect sales tax.

REVISED 3/13/2019

Do I have to fill this certificate out for every purchase?

In many cases, this certificate can be used as a blanket certificate, so that you will only need to fill it out once for each of your Sellers. Some states require periodic replacement with a fresh certificate (see notes on certificate). To make filling out the certificate easier, you should fill out your information and all information that does not change, then make photocopies, and then fill out the information that is specific to the transaction.

Can this certificate be used as a blanket certificate?

In many states this certificate can be used as a blanket certificate. You should verify this with the applicable state. A blanket certificate is one that can be kept on file for multiple transactions between a specific Buyer and specific Seller.

Who determines whether this certificate will be accepted?

The Seller will determine whether it will accept the certificate from the Buyer generally according to a good faith standard. The applicable state will determine whether a certificate is acceptable for the purpose of demonstrating that sales tax was properly exempted. The applicable state will generally be the state where the Seller is located or the state where the sales transaction took place, or where the Buyer is located. The Multistate Tax Commission does not determine whether this certificate will be accepted either by the Seller or the applicable state.

I have been asked to accept this certificate. How do I know whether I should accept it?

You should contact your state revenue department if you are not familiar with the policies regarding acceptance of resale exemption certificates.

In order for the certificate to be accepted in good faith by the Seller, Seller must exercise care that the property or service being sold is of a type normally sold wholesale, resold, leased, rented or incorporated as an ingredient or component of a product manufactured by Buyer and then resold in the usual course of its business. A Seller failing to exercise care could be held liable for the sales tax due in some states.

Is there a more recent version of this certificate?

No. The most recent version is posted on our website. You may have seen a version that has been modified in an unauthorized manner. You should not use any version other than the one available on our website.

Whom should I talk to for more information?

For information regarding whether the certificate will be accepted in the applicable state, you should talk to the revenue department of that state. The Multistate Tax Commission’s Member States webpage has links to revenue department websites. For other questions that have not been addressed by these FAQs, you may contact Elliott Dubin at the Multistate Tax Commission, 202-650-0300

REVISED 3/13/2019

7