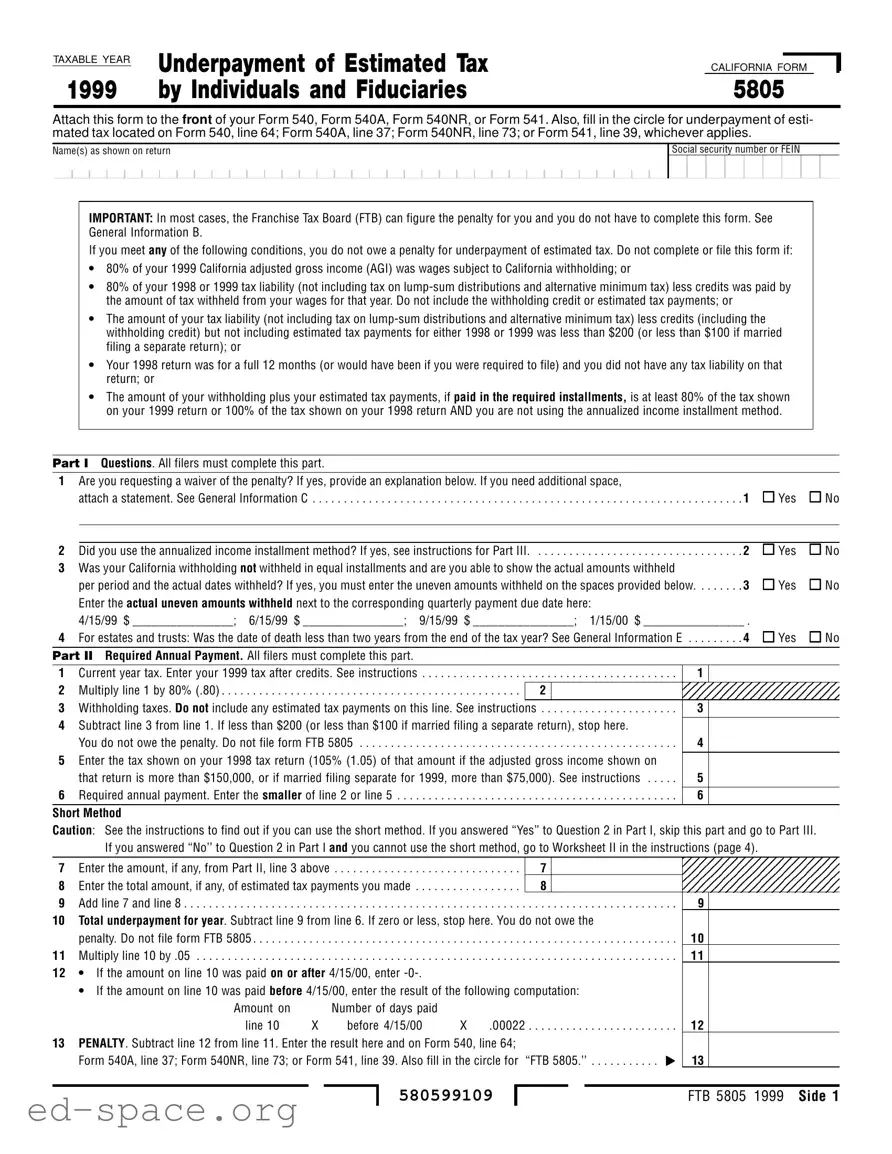

General Information

A Purpose

Use form FTB 5805 to see if you owe a penalty for underpaying your estimated tax and, if you do, to figure the amount of the penalty.

B Who Must File

Generally, you do not have to complete this form. The Franchise Tax Board (FTB) can figure the amount of any penalty for you and send you a bill after you have filed your return. If the FTB figures your penalty and sends you a bill, you must pay the penalty within 15 days of the billing to avoid additional interest charges.

Important: If you answered “Yes” to any of the questions in Part I (estates and trusts, see General Information E), you must complete this form and attach it to the front of your return.

C Waiver of the Penalty

You may request a waiver of the penalty if:

•You underpaid an estimated tax installment due to a casualty, disaster, or other unusual circumstance and it would be inequitable to impose the penalty; or

•You retired after age 62 or became disabled in 1998 or 1999 and your underpayment was due to reasonable cause.

To request a waiver:

•Check “Yes” on form FTB 5805, Part I, Question 1, and in the space provided, explain why you are requesting a waiver of the estimate penalty. If you need additional space, attach a statement;

•Complete form FTB 5805 through Part II, line 12 (Worksheet II, line 15 if you use the regular method) without regard to the waiver. Write the amount you want waived in parenthesis on the dotted line next to Part II, line 13 (Worksheet II, line 16 if you use the regular method). Subtract this amount from the total penalty you figured without regard to the waiver, and enter the result on Part II, line 13 (Worksheet II, line 16 if you use the regular method);

•Fill in the circle on Form 540, line 64;

Form 540NR, line 73; or Form 541, line 39; and

•Attach form FTB 5805 to the front of your return on top of any check, money order, Form W-2, Form 1099, or other special documentation.

D Annualized Income

Installment Method

If your income varied during the year and you use the annualized income installment method to determine your estimate payment requirements, you must complete form FTB 5805, including Side 2. Attach it to the front of your return on top of any check, money order, Form W-2, Form 1099, or other special documentation. Also fill in the circle on your return for underpayment of estimated tax.

E Estates and Trusts

Estates and trusts are required to make quarterly estimated tax payments. Estates and grantor trusts, which receive the residue of the decedent’s estate, are required to make estimated income tax payments for any year ending two or more years after the date of the decedent’s death. If you answered “Yes” to Question 4, complete Part I only and attach form FTB 5805 to the front of your return.

Note: Exempt trusts should use form FTB 5806, Underpayment of Estimated Tax by Corporations.

F Nonresidents and New Residents

The penalty for the underpayment of estimated tax applies to nonresidents and new residents. See the conditions listed in the box labeled “Impor- tant” on Side 1 of form FTB 5805.

G Farmers and Fishermen

You are considered a farmer or fisherman if at least two-thirds (2/3) of your annual gross income for 1998 or 1999 is from farming or fishing. Farmers and fishermen are required to make one estimate payment. For calendar year taxpayers, the due date is January 15, 2000. If you file Form 540 or Form 541 and pay the entire tax due by March 1, 2000, you do not owe a penalty for underpaying estimated tax. Otherwise, use form FTB 5805F, Underpayment of Estimated Tax by Farmers and Fishermen, to figure your penalty.

H Due Dates for Estimated Tax Installments

If you are a calendar year taxpayer, the estimated tax installment due dates for 1999 were:

• First quarter |

— April 15, 1999 |

•Second quarter — June 15, 1999

• Third quarter |

— September 15, 1999 |

•Fourth quarter — January 15, 2000

Fiscal-year filers must pay estimated tax installments on the 15th day of the 4th, 6th, and 9th months of their fiscal year, and the 1st month of the following fiscal year.

The penalty is figured separately for each due date. Therefore, you may owe a penalty for an earlier installment due date, even if you pay enough tax later to make up the underpayment.

If a due date falls on a Saturday, Sunday, or legal holiday, use the next business day.

I Filing an Early Return in Place of the 4th Installment

If you file your 1999 tax return by February 1, 2000, and pay the entire balance due, you do not have to make your last estimate payment. Fiscal- year filers must file their return and pay their tax before the first day of the 2nd month after the end of their taxable year.

J Amended Return

If you file an amended return:

•On or before the due date of your original return, use the tax, credit and other amounts shown on your amended return to figure your penalty for underpayment of estimated tax.

•After the due date of the original return, you must use the amounts shown on the original return to figure the penalty.

K Penalty Rates

The rates used to determine the amount of your penalty are established at various dates through- out the year. If an installment of estimated tax for any quarter remained unpaid or underpaid for more than one rate period, the penalty for that underpayment will be figured using more than one rate when applicable.

The following rates apply to the 1999 computation period:

•8% 4-15-99 through 6-30-99

•7% 7-1-99 through 12-31-99

•8% 1-1-00 through 6-30-00

Fiscal-year filers: the rates for the periods 7/1/00 through 12/31/00 and 1/1/01 through 3/15/01 will be determined by the FTB in March 2000 and September 2000, respectively.

Call the FTB’s automated toll-free phone service to get updated penalty rates. Call the number below, select personal income tax information, follow the recorded instructions, and enter code number 403 when instructed.

The automated toll-free phone service is available in English and Spanish to callers with touch-tone telephones 24 hours a day, seven days a week.

From within the |

|

United States, call |

(800) 338-0505 |

From outside the United States,

call (not toll free) . . . . . . . . . . . . (916) 845-6600

Specific Line Instructions

Part II — Computing the Required Annual Payment

Use this part to figure the amount of estimated tax that you were required to pay.

Certain high-income taxpayers are required to use 105% (instead of 100%) of the tax shown on their previous year’s return in the computation of the required annual payment. See the instructions for line 5.

Line 1 – Enter your tax liability (excluding any tax on lump-sum distributions) from your 1999 Form 540, line 34; Form 540A, line 23;

Form 540NR, line 43; or Form 541, line 25.

Line 3 – Enter the amounts from your 1999

Form 540, line 38 and line 41; Form 540A, line 24 and line 27; Form 540NR, line 47 and line 50; or Form 541, line 28.

Line 5 – Enter your tax liability (excluding any tax on lump-sum distributions) from your 1998 Form 540, line 34; Form 540A, line 23;

Form 540NR, line 43; or Form 541, line 25.