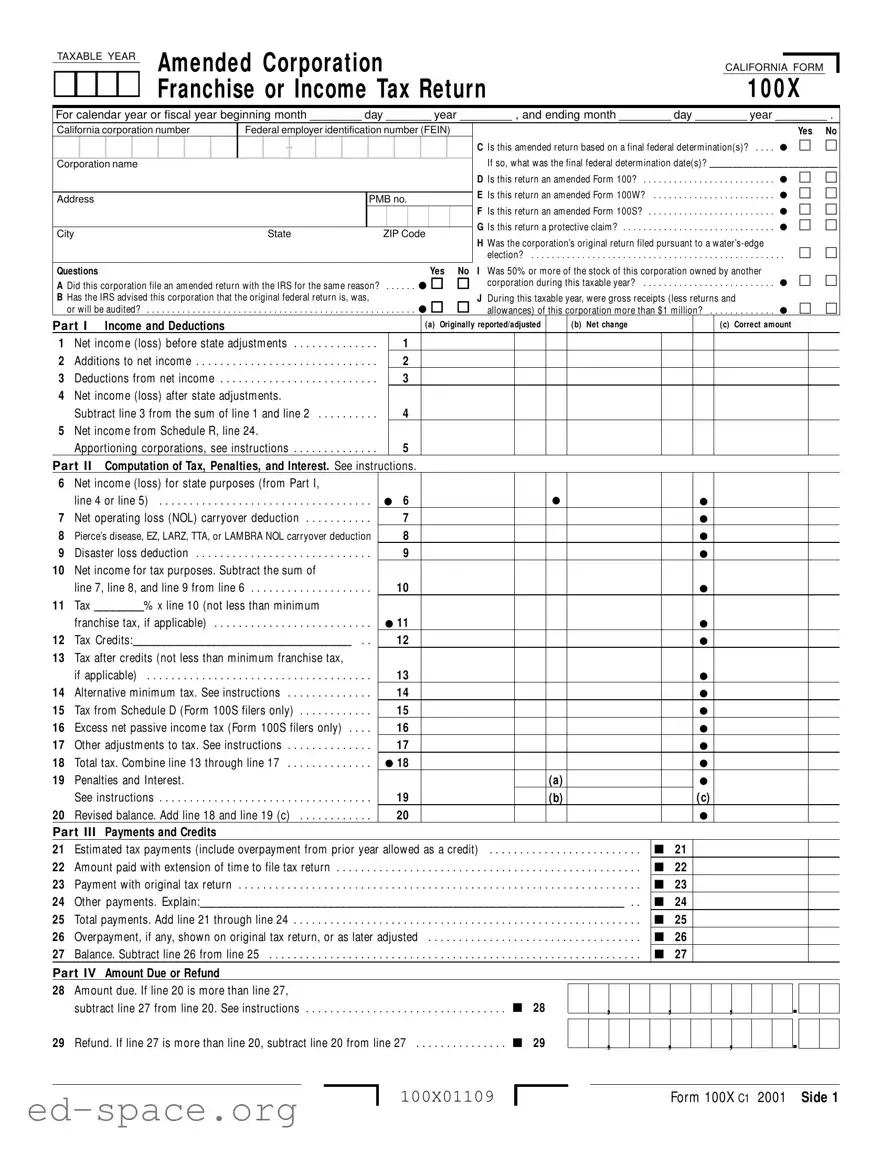

Column (b) – Enter the net increase or the net decrease for each line changed. List each change on Side 2, Part V, question 2 and provide an explanation and supporting schedules for each change.

Column (c) – Add any increase in colum n (b) to the am ount in colum n (a) or subtract any decrease in colum n (b) from the am ount in colum n (a) and enter the result in colum n (c) . If there is no change, enter the am ount from colum n (a) in colum n (c) .

Part I Income and Deductions

Line 5 – Net income from Schedule R

If the corporate taxpayer apportions its business incom e to California and there is a net change in the am ount of net business incom e (loss) after state adjustm ents apportioned to the corporate taxpayer, then the corporate taxpayer m ust recom pute and attach Schedule R, Apportionm ent and Allocation of Incom e.

Part II Computation of Tax, Penalties, and Interest

For additional inform ation (such as applicable tax rates or instructions on how to determ ine net operating loss carr yover, alternative

m inim um tax (AM T), excess net passive incom e tax, etc.) refer to Form 100, Form 100W, or Form 100S instructions for the taxable year being am ended.

Line 14 – Alternative minimum tax (AM T)

Note: This applies to Form 100 or Form 100W filers only.

Enter in colum n (b) the net increase or net decrease in AM T betw een the original Schedule P (100), Alternative M inim um Tax and Credit Lim itations – Corporations, or Schedule P (100W), Alternative M inim um Tax and Credit Lim itations – Water’s- Edge Filers, and the am ended Schedule P (100) or Schedule P (100W) . Be sure to attach the am ended Schedule P (100) or

Schedule P (100W) to Form 100X.

Line 17 – Other adjustments to tax

For interest adjustm ents under the “ look- back” m ethod of com pleted long- term contracts, enter the net increase or net decrease in colum n (b) . Be sure to sign the am ended form FTB 3834, Interest Com puta- tion Under the Look- Back M ethod for

Com pleted Long- Term Contracts, and attach it to Form 100X.

Also, enter in colum n (b) the net increase or net decrease of any credit recapture, LIFO recapture, or tax on installm ent sales. For

m ore inform ation, get Form 100, Form 100W, or Form 100S, Schedule J, Add- on Taxes and Recapture of Tax Credits, for taxable years 1991 through 2001 or get Form 100 or

Form 100S instructions for taxable years 1988 through 1990.

Enter the increase or decrease to the $600 prepaym ent m inim um franchise tax for qualified new corporations per California Revenue and Taxation Code Section 23221,

effective for taxable years beginning on or after January 1, 1997, and before Januar y 1, 1999. Enter the increase or decrease to the $300 prepaym ent for taxable years beginning on or after Januar y 1, 1999, and before Januar y 1, 2000. (For corporations incorpo- rating on or after Januar y 1, 2000, there is no prepaym ent.)

Line 19 – Penalties and Interest

Line 19 (a) – In colum n (b) enter the net increase or net decrease of any penalties being reported on the am ended return.

Line 19 (b) – In colum n (b) enter the net increase or net decrease of interest being reported on the am ended return.

Line 19 (c) – In colum n (c) enter the total of line 19 colum n (a) and colum n (b) .

If the corporation does not com pute the interest due, FTB w ill figure any interest due and bill the corporation. Interest accrues on the unpaid tax from the original due date of the return to the date paid. For the applicable interest rates, get FTB Pub. 1138A, Bank and Corporation Billing Inform ation.

Part III Payments and Credits

Enter any paym ents or credits on the appropriate line.

Part IV Amount Due or Refund

Line 28 – Amount due

M ake the check or m oney order payable to the

“Franchise Tax Board” for the am ount show n on line 28. Write the California corporation num ber and taxable year on the check. Attach the check to the front of Form 100X.

Note: A corporation required to pay its taxes through EFT m ust m ake all paym ents by EFT, even if the tax due on the original tax return w as paid by check or m oney order. Indicate w hich taxable year the paym ent should be applied to w hen paying by EFT.

Line 29 – Refund

If the corporation is entitled to a refund larger than the am ount claim ed on the original tax return, line 29 w ill show the am ount of refund. The FTB w ill figure any interest due and w ill include it in the refund. If you are claim ing a refund for interest previously paid, include the interest am ount on line 19.

Part V Explanation of

Changes

Line 1

If the original tax return w as filed using a different Corporation nam e, address, and/or California corporation num ber, enter the nam e, address, and California corporation num ber used on the original tax return on this line.

Line 2

Explain in detail any changes m ade to the

am ounts listed in Side 1, colum n (a) . Include in your explanation the line num ber refer- ences for both the original and am ended tax

returns and any detailed com putations. Include a copy of the federal Form 1120X and schedules if a change w as m ade to the federal return. Include the corporation’s nam e and California corporation num ber on all attachm ents.

Where to Get Tax Forms and Publications

By Internet – You can dow nload, view, and print California bank and corporation tax form s and publications. Go to our Website at:

www. ftb. ca. gov

By phone – To order 2001 business entity tax form s call (800) 338- 0505 and follow the recorded instructions. This ser vice is available to callers w ith touchtone phones from 6 a.m . to 8 p.m ., M onday through Friday except state holidays. Please allow tw o w eeks to receive your order. If you live outside of California, please allow three w eeks to receive your order.

By mail – Write to:

TAX FORM S REQUEST UNIT FRANCHISE TAX BOARD PO BOX 307

RANCHO CORDOVA CA 95741- 0307

General Toll- Free Phone Service

Our general toll- free phone ser vice is available M onday through Friday, from 7 a.m . until

8p.m and from 8 a.m . until 5 p.m . on Saturdays.

Note: We m ay m odify these hours w ithout notice to m eet operational needs.

From w ithin the |

|

|

United States |

(800) |

852- 5711 |

From outside the |

|

|

United States |

(916) |

845- 6500 |

|

(not toll- free) |

Assistance for persons with disabilities The FTB com plies w ith the Am ericans w ith Disabilities Act. Persons w ith hearing or speech im pairm ents call:

From voice phone

(California Relay Ser vice) . . . . (800) 735- 2922

From TTY/TDD (Direct line to FTB

custom er service) . . . . . . . . (800) 822- 6268

For all other assistance or

special accom m odations . . (800) 852- 5711